Ensure any minimal is a price you’re comfy putting to the a good savings account. Both, there are casinolead.ca this article also hats one limit the money matter that can earn the fresh high APY, therefore restricting your own desire-getting possible. Not simply does your money earn a far greater get back in the a good high-produce checking account compared to traditional offers, but you continue to have entry to finances if you want it as you would in the a consistent savings account.

The way we make money

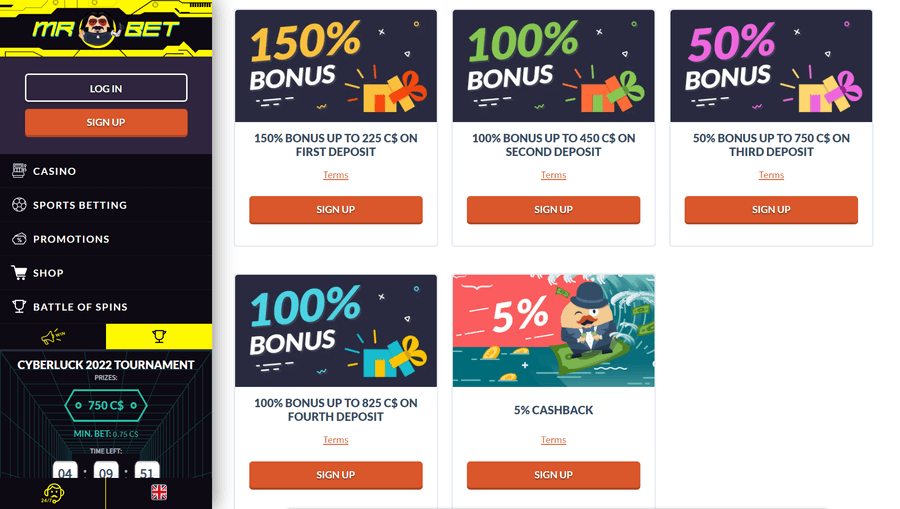

These types of zero-deposit casino extra requirements are in the newest table in person more than. The most used option for redeeming a no-deposit added bonus is simply to simply click all backlinks a lot more than. Once you’ve done the brand new registration processes, bonus money is actually instantly placed into your membership. No actual bonus code must claim the fresh no deposit bonus. Risk.you try a great cryptocurrency local casino that give new users with a great 550,000 GC and you will $55 South carolina no-deposit bonus, for only joining and you can log in each day to possess 1 month. The platform also offers over 500 games from reliable organization including Practical Enjoy and you may Hacksaw Gaming, possesses a unique number of Share Originals titles.

Friend Financial Savings account

That it large-hearted offer results in $/€50 on the bonus account that have an excellent 50x enjoy-as a result of needs. There’ll be more enjoyable also offers once you begin playing on the site. Since the percentage is prosperous, you will discovered 50 bonus spins in the Search out of Thrill slot video game. The simple-supposed 5×step three reel position has money in order to athlete (RTP) of 97.13% and you can a maximum earn of 5000x. Ahead of i wade any longer, let’s talk about the icing for the pie, the newest $/€step one deposit provide. The fresh gambling enterprise usually invited you to a highly-appreciated video slot inside about three procedures.

Timeliness of government income tax dumps.

Use ANZ Web sites Financial, cell phone financial or check out an ANZ branch to deal with and find out your interest money. To improve your interest fee regularity from the maturity or in this seven days following identity deposit grows up. Just remember one to making withdrawals or incurring people charge or charge to your a family savings you are going to disqualify you against generating added bonus focus – so be sure to check out the equipment conditions and terms.

The filing address might have altered of that used to file your a career income tax come back inside previous ages. If you’lso are filing the income tax get back electronically, a valid EIN is necessary during the time the new come back try registered. In the event the a legitimate EIN isn’t provided, the brand new come back will never be approved. If you forever walk out business or avoid using earnings to the team, you must document a final come back. To share with the fresh Internal revenue service one Form 941 to have a specific quarter can be your final get back, see the field online 17 and enter the latest time your paid back wages. In addition to install a statement to your get back appearing title away from the person keeping the fresh payroll information plus the target where those people info might possibly be kept.

As to why Jenius Lender?

The full stimuli consider will be built to the individuals earning quicker than simply $75,100000 ($150,100000 to own partners) and you can manage stage out to no of these getting more than $99,100 ($198,000 to have partners). Lead from family tax filers gets a complete payment when the they earned $112,five-hundred or smaller. Usually the one major issue using this type of bipartisan stimulus suggestion would be the fact it generally does not are investment for the next round from stimuli inspections. However the $918 billion proposal (of Trump/Mnuchin shown less than) does have a stimulus view percentage! Clearly in the desk lower than, which shows the various parts being funded for example extended jobless advantages and COVID inoculation shipment, there isn’t any line goods to possess monetary impact costs (an excellent.k.a great stimuli checks).

What you should learn about large-give discounts account

The brand new trust finance recovery punishment won’t apply to any level of faith financing fees an employer holds back in anticipation of every loans he could be eligible to. Document the very first Setting 941 to the one-fourth where you very first repaid earnings which might be subject to personal defense and you may Medicare taxation otherwise at the mercy of government taxation withholding. If you pay wages subject to federal tax withholding otherwise social protection and you will Medicare taxation, you need to document Mode 941 every quarter in order to statement another number. Enterprises will enjoy some great benefits of filing tax statements and you may investing the government taxation electronically. If or not your have confidence in a taxation professional otherwise handle the taxes, the new Irs gives you easier and safer applications making processing and you may using smoother. Save money go out worrying all about fees and a lot more date running the team.