Posts

As a result of the reduce commission needs and you will waived PMI there is normally a price as paid to utilize a physician https://vogueplay.com/au/lucky-red-casino-review/ loan. You to price will come when it comes to a higher desire rates (0.125% in order to 0.25% greater than a normal mortgage) or in high costs. Some medical professionals are finding expert rates and you may charges which might be comparable in order to a traditional mortgage.

Danh mục bài viết

Services

An automated 90-time extension of time to file Form 8966 is generally asked. To help you request an automatic 90-day extension of time to file Function 8966, file Function 8809-We. Comprehend the Guidelines to possess Mode 8809-I to own where you should file you to mode. You should demand an extension once you are aware you to definitely an expansion becomes necessary, however, zero after versus deadline to have submitting Mode 8966. Below certain hardship conditions, the fresh Irs can get grant a supplementary 90-go out extension to help you file Form 8966.

Don’t blog post the social defense matter (SSN) and other confidential details about social networking sites. Always protect your identity while using people social network web site. The newest tax treaty dining tables in the past within this book were current and you may moved to Internal revenue service.gov/Individuals/International-Taxpayers/Tax-Treaty-Dining tables. A good “reporting Model 2 FFI” is an FFI revealed inside a design dos IGA who has agreed to conform to the needs of an enthusiastic FFI agreement which have value so you can a part.

A foreign person will be claim the brand new direct dividend rate from the filing the correct Form W-8. These types of exemptions apply even if you do not have any files in the payee. Which standard needs, it is not limited to help you, compliance to your after the regulations. A great WP is get rid of as its head people the individuals indirect lovers of the WP where they is applicable mutual membership treatment or the brand new company alternative (revealed after). A great WP must otherwise issue a form 1042-S to every mate for the the quantity it is necessary to exercise within the WP contract. You can even topic a single Form 1042-S for all repayments you create so you can a good WP other than money in which the new entity cannot act as an excellent WP.

- Agency of the Treasury and you can state banking authorities to add their subscribers that have a secure, safe fee services.

- Consequently, number maybe not susceptible to section step three withholding and this commonly withholdable repayments that will be repaid in order to a great You.S. part are not susceptible to Function 1099 reporting or backup withholding.

- Which listing has just websites that offer the very best sort of on the internet banking, credit/debit notes, e-wallets, prepaid service coupon codes, or any other procedures, all of which have to be prompt, easier, and you may protected by the brand new SSL encryption and firewalls.

American Tower Company (AMT)

The choice relies on debt desires, exposure threshold, and government preferences. A house normally also offers more secure output, possible income tax benefits, and you can rental money but requires effective government and you can big very first opportunities. Stocks give highest prospective output, better exchangeability, minimizing restoration conditions but i have far more price volatility. Realty Money Corp is an excellent REIT which had been founded inside the 1969 to your number 1 intent behind getting buyers having monthly money one manage increase throughout the years. Realty Income’s dividends are paid off of funds made due to leased a house, and because going public inside the 1994, the business has expanded their collection so you can over 11,100 characteristics throughout fifty says (and Puerto Rico, the new U.K. and The country of spain).

Physician mortgage loans in addition to basically just go through the full necessary college student financing percentage, not extent owed, and they will essentially deal with a finalized work deal while the research of income, as opposed to demanding tax stubs. Separate designers have a tendency to nevertheless you desire two years out of taxation statements to help you establish earnings. System is actually accessible to all of the being qualified physicians no matter ages within the habit, flexible underwriting to the student education loans, down payment and reserves is generally skilled, excellent buyer services, and you can employed financing repair. We specialize in doctor credit and also have over 20 years of experience in mortgage loan originations.

Guarantee Residential

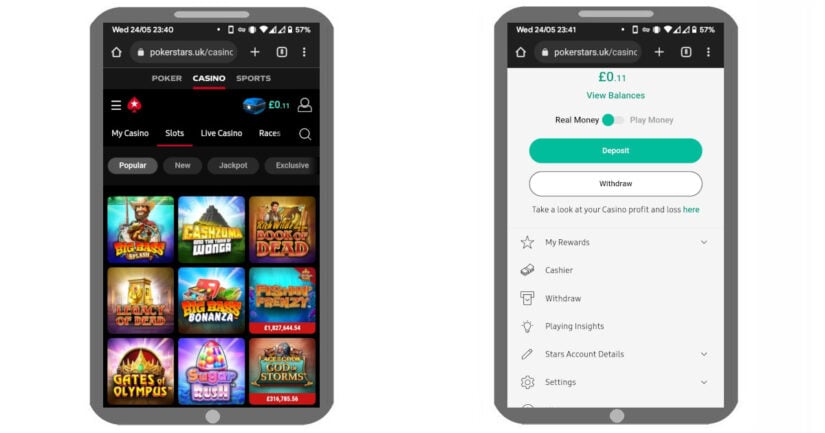

To arrive at the base of that it, we need to look at the appropriate betting regulations. First, betting in the usa try managed to the a state, federal, and you will, needless to say, regional top. Thinking about these amounts of laws and regulations, the only viable speculation you could obtain would be the fact things are destined to get messy. PartyPoker revealed within the 2001, possesses centered a good reputation in that date. It successfully caters to each other college student and more seasoned professionals, and you will strong, reputable defense has helped it become one of the most respected poker web sites. Other unique element of PartyPoker is the normal casino poker Series you to they works, providing big prizepools and you may fun tournaments drawing thousands of participants.

For individuals who currently have a current representative or financial advisor, create a chat to speak along the principles from actual house investing and how it does squeeze into debt package. You could imagine getting in touch with local real estate professionals observe if they want to review the basics and you may strongly recommend valuable tips. Linking having local owning a home lovers will be a means to fix build relationships the real property neighborhood and you will grow your training.

For those who continue getting the fresh selling continues for the some other investment property, you might delayed funding gains taxation indefinitely. Luckily, there are ways to remove them on your own household selling, or prevent them entirely. The new Internal revenue service offers a number of conditions to avoid financing growth taxation when selling your house. Generally, money gains tax ‘s the income tax due to the funds (aka, the main city get) you create when you sell a financial investment or advantage, together with your family. It is computed because of the deducting the new resource’s brand new prices or purchase price (the brand new “tax foundation”), as well as one expenditures obtain, on the finally sales speed.

Tax Notices to have Indians with Dubai Assets: Trick Home elevators the brand new FAIU, Black Currency Act, and you will To another country Taxation Ramifications

If you are wanting a realtor the newest Light Finish Trader couples with CurbsideRealEstate.com, a free of charge a property concierge solution to have medical professionals, from the physicians. Just after troubled due to his first home get, Dr. Peter Kim based Curbside A home to address physician-certain items discovered in the home buying process. In addition to taking development and you can suggestions, CurbsideRealEstate.com can be your doctor-provided “curbside demand” to have physician mortgages, professional real estate agents, relocation, and you can everything in ranging from. Whether or not your’lso are securing your first medical practitioner financial, merely birth your property lookup, otherwise you are not sure the direction to go, CurbsideRealEstate.com can help you browse the house to find processes confidently and you may effectively, helping you save work-time and money. From the NEO Lenders, i are experts in flipping the newest hopeless for the possible for medical professionals and you can other physicians looking to a mortgage.

Leasing Earnings and cash Disperse Possible

For individuals who wear’t have to endure the brand new nightmare away from controlling an excellent rental possessions otherwise can be’t build the brand new deposit, owning a home trusts (REITs) are an easy way to start committing to a property. In the event the a residential otherwise overseas union which have people foreign partners disposes away from a good USRPI at the an increase, the fresh obtain is actually addressed since the ECI which can be fundamentally at the mercy of the guidelines explained earlier under Connection Withholding to the ECTI. A foreign connection one disposes of a great USRPI could possibly get borrowing from the bank the newest taxation withheld because of the transferee up against the taxation liability computed lower than the relationship withholding on the ECTI regulations. It signal enforce if the property thrown away is actually acquired from the the new transferee to be used by transferee while the a property. In case your amount knew to your such as temper cannot surpass $300,000, no withholding is required. If you don’t, the new transferee must fundamentally keep back ten% of the count realized by a foreign person.

Invest in Turnkey Functions

A foreign union you may own the new USRP, in a way that an interest in the brand new international relationship is generally managed because the an enthusiastic intangible and not felt situated in the united states. You will find specific chance that the Internal revenue service might take a lookthrough means in line with the aggregate approach to treating conversion and exchanges of union interests inside the Secs. 864(c)(8) and you can 1446(f) and check on the situs of the underlying union assets to find the precise location of the USRP.

Industrial a home advantages from comparably extended book agreements which have tenants than just residential a home. This gives the economic a property manager a lot of income stability. No. The new Maine a house withholding amount is actually merely a quote of one’s income tax due to your obtain regarding the sale of your Maine possessions. A Maine taxation come back need to be filed to find the genuine income tax owed on the obtain and you may even when a good refund is due to your. In some instances, an additional count can be due to the Maine tax go back submitted.